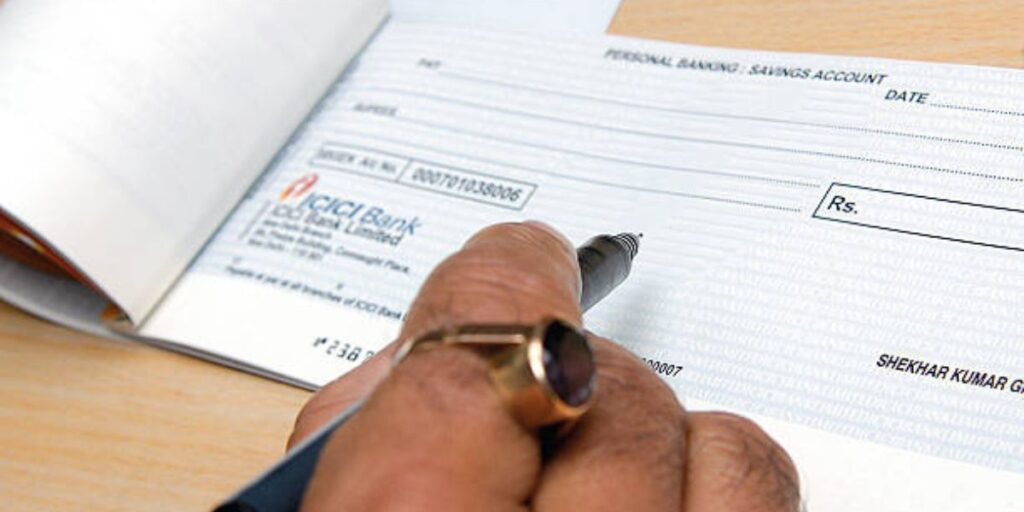

Writing a cheque might seem like an old-fashioned task in today’s digital age, but it’s still a valuable skill to have. Whether you’re paying rent, giving a gift, or making a donation, knowing how to properly fill out a cheque ensures your payment is processed smoothly. Here’s a step-by-step guide to help you fill a cheque correctly and confidently.

Step 1: Date the Cheque

In the top right corner, you’ll find a space for the date. Write the current date here. Use the format that’s most common in your country (e.g., MM/DD/YYYY in the U.S. or DD/MM/YYYY in many other parts of the world). This ensures the cheque is valid and timely.

Step 2: Payee Name

Next, you’ll see a line that says “Pay to the order of.” This is where you write the name of the person or organization you’re paying. Make sure to write clearly and accurately. If the payee’s name is misspelled or incomplete, they might have trouble cashing or depositing the cheque.

Step 3: Amount in Numbers

To the right of the payee’s name, there’s a box with a dollar sign or currency symbol. Write the amount of the cheque in numbers here. For example, if you’re paying $150.75, write “150.75” in this box. Be precise, and ensure the numbers are legible.

Step 4: Amount in Words

Below the payee line, you’ll find a blank line to write out the amount in words. This step helps prevent fraud and errors. Start at the far left of the line and write the amount in words. For $150.75, you would write “One hundred fifty and 75/100.” Draw a line through the remaining space to the right to prevent anyone from adding extra words or numbers.

Step 5: Memo Line (Optional)

The memo line, usually located in the bottom left corner, is optional but helpful. Here, you can note the purpose of the cheque, such as “Rent for July” or “Birthday Gift.” This is especially useful for your own records or if the recipient needs a reminder of what the payment is for.

Step 6: Signature

Finally, sign your name on the signature line in the bottom right corner. Use the same signature that your bank has on file. Your cheque won’t be valid without this signature, so don’t forget this crucial step.

The signature is arguably the most critical part of the cheque. Without it, your cheque is invalid, and the bank will refuse to process it. Think of your signature as your personal stamp of approval. It authorizes the bank to release the specified amount from your account to the payee. Let’s dive deeper into the importance of your signature, some common pitfalls to avoid, and to ensure your cheque is processed without any hiccups.

7.Why Your Signature is Crucial

When you sign the cheque, you’re verifying that you agree to pay the specified amount to the recipient. It also serves as a security measure. Since banks have your signature on file (from when you opened the account), they can compare the signature on the cheque with the one they have. This helps to protect both you and the bank from fraud. If the signature doesn’t match the bank’s records, the cheque will likely be rejected.

Additionally, your signature signifies that you’re the authorized individual to withdraw or spend money from your account. For joint accounts, it’s essential to remember who has signing authority, as some accounts require one signature, while others may need two.

8.How to Sign Your Cheque Properly

1.Use the Correct Signature: Make sure the signature you use on the cheque matches the one on file with your bank. If your signature has evolved or changed over time, it’s wise to update it with the bank to avoid any issues. Keep in mind that banks are very particular about signature mismatches, as this is a critical anti-fraud measure.

2.Signature Placement: The signature line is located at the bottom right-hand corner of the cheque. Ensure that you sign within the space provided and that your signature doesn’t extend into other sections of the cheque, such as the memo line or the numerical amount box.

3.Use the Same Signature Style: If your signature is legible, keep it that way. If it’s more of a scribble, stick with that. Banks are used to dealing with various signature styles, but consistency is key. Any sudden deviations from your usual style may raise red flags and result in your cheque being questioned or even rejected.

4.Don’t Leave the Signature Line Blank: If you don’t sign your cheque immediately, someone else could fraudulently sign it and cash it. Always sign the cheque as soon as you’ve filled it out and ensure no other spaces are left blank.

Goto : Homepage